REGULATORY REPORTING SERVICES

The proliferation of regulatory reporting requirements have a widespread impact on all industry players, whether directly or indirectly. Besides having to comply to regulations directly addressed to them, buy-side asset managers may also be impacted by regulations of their institutional and insurance clients as they are required to provide the necessary data for their clients to produce their regulatory reports. In a lot of cases, fulfilling these reporting obligations is not a strategic task for the organization.

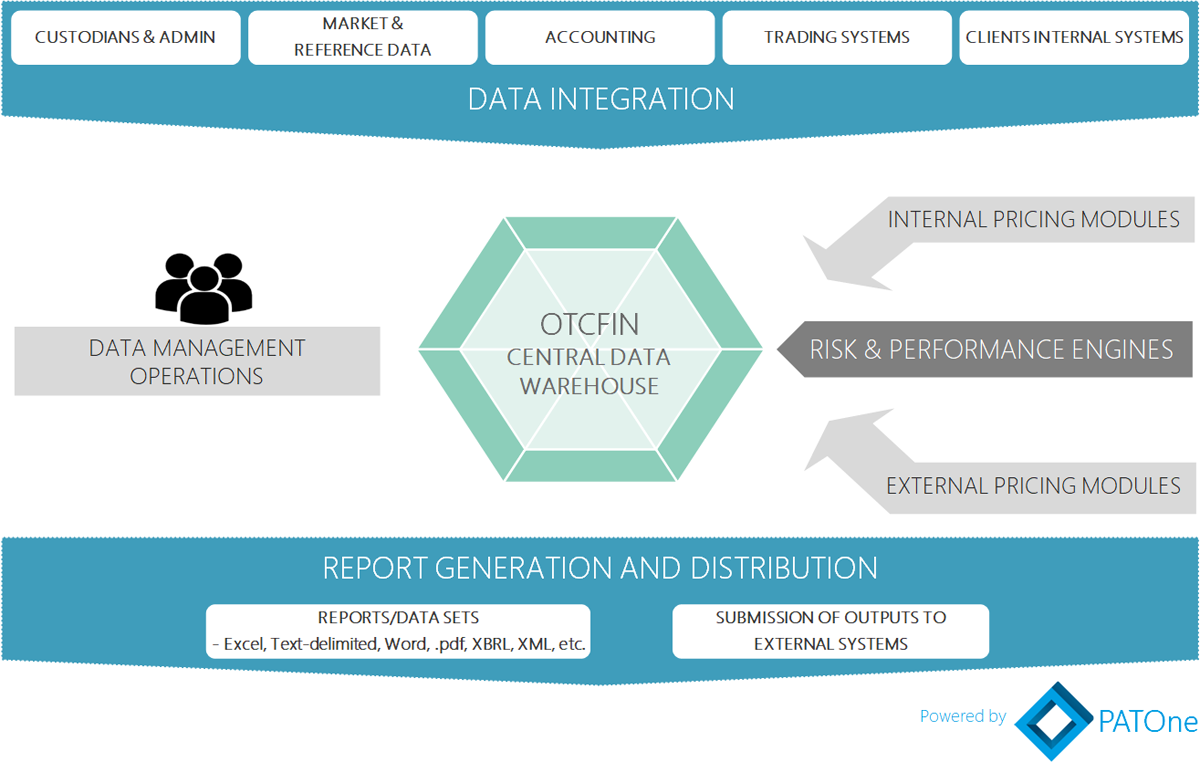

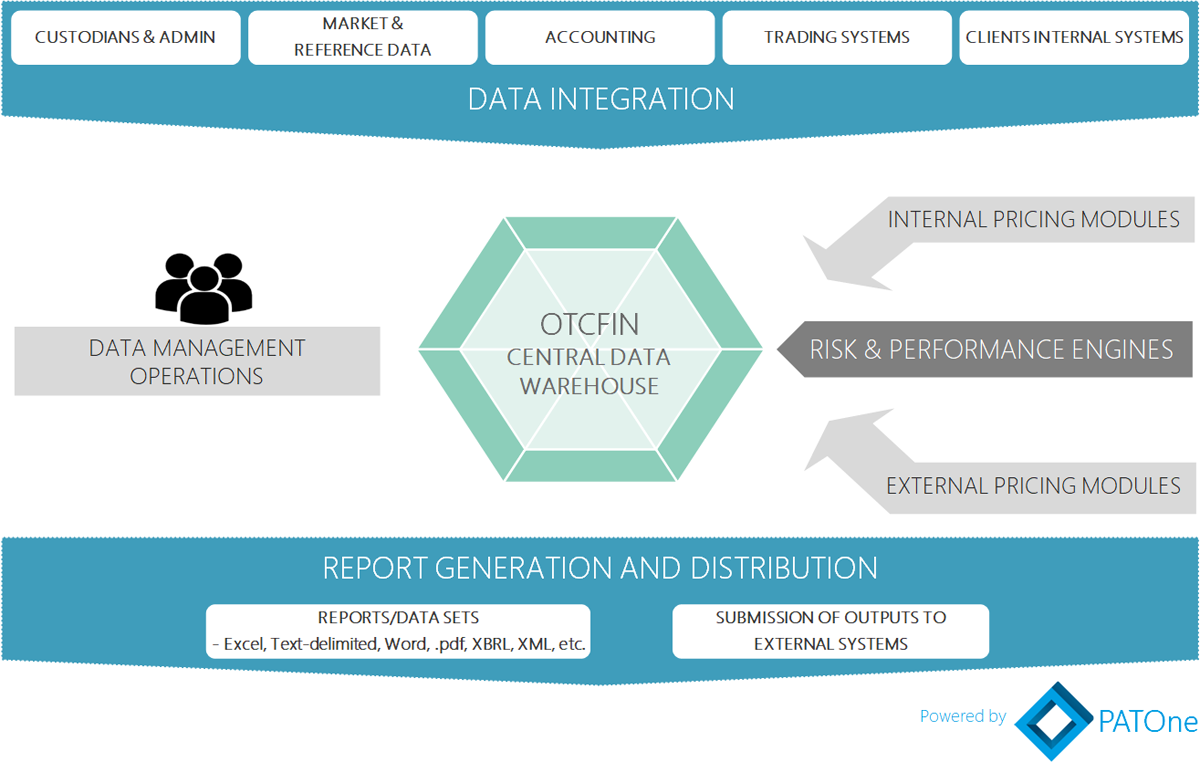

Regulatory reporting requires in-depth analysis and understanding of the regulation in question, having a mastery of the required data and computations and being able to produce the output in the format stipulated by the regulation. Our Managed Service team can help alleviate this burden by performing all the data preparation, computation, data quality monitoring and report generation tasks using our PATOne EDM platform.

Our regulatory business analysts have hands-on experience applying the various regulations and we actively participate in the respective industry discussions shaping each regulation. We are able to agilely capture regulatory updates in the platform.