MMFR

01

Comprehensive Managed Service

Our experienced team will assist you in applying the regulation for your specific funds. We support processing all the required data needed to perform stress tests, compliance checks and generate the appropriate outputs. Taking advantage of our Managed Services also saves you the operational burden of deploying additional staff and hardware to on-board and maintain the regulatory reporting requirements.

02

Automated Data Management Process

Input data sourcing and validation are performed efficiently by our proprietary PATOne EDM which flexibly handles data provided in different formats. Clients may give us their data in the format most convenient to them.

03

Sensitivities and Stress Testing Computations

Sensitivity and Stress Testing computations are performed by the PATOne Financial Library and/or via integration with third-party systems like The Yield Book. The outputs are iteratively checked by the application to ensure that the MMFs stay within the prescribed limits.

04

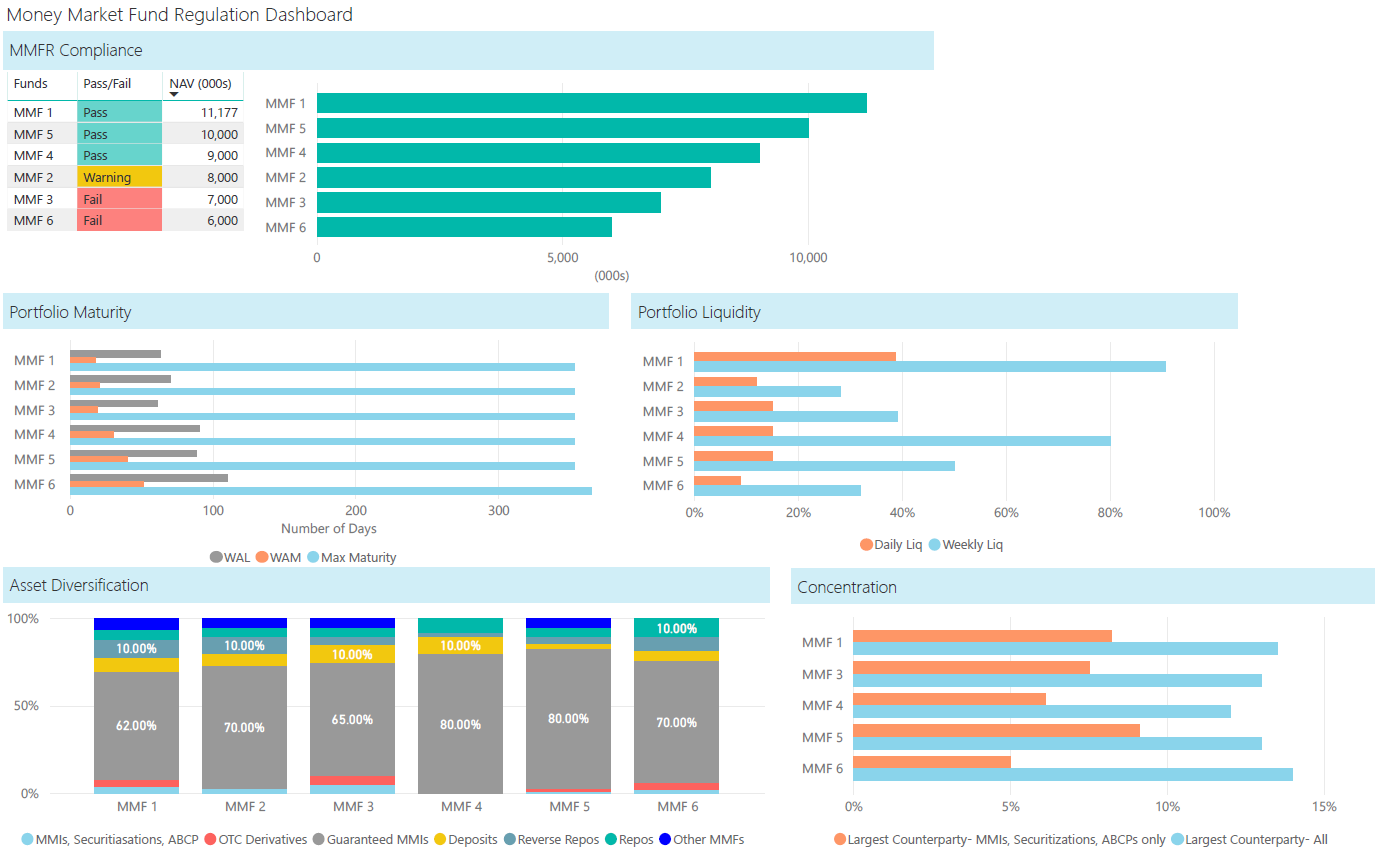

Interactive Compliance Wizard and Dashboards

Clients have full transparency to the data and computations workflow each step of the way and may interactively update and validate the input data via the step-by-step MMF Wizard. User-friendly dashboards provide summary statistics of the clients’ MMF funds, highlighting any potential breaches or near-breaches in the fund.

05

Standard Report Generation

Upon validation of data quality and compliance checks, the standardized report outputs can be generated and downloaded at the click of a button.