SOLVENCY II

01

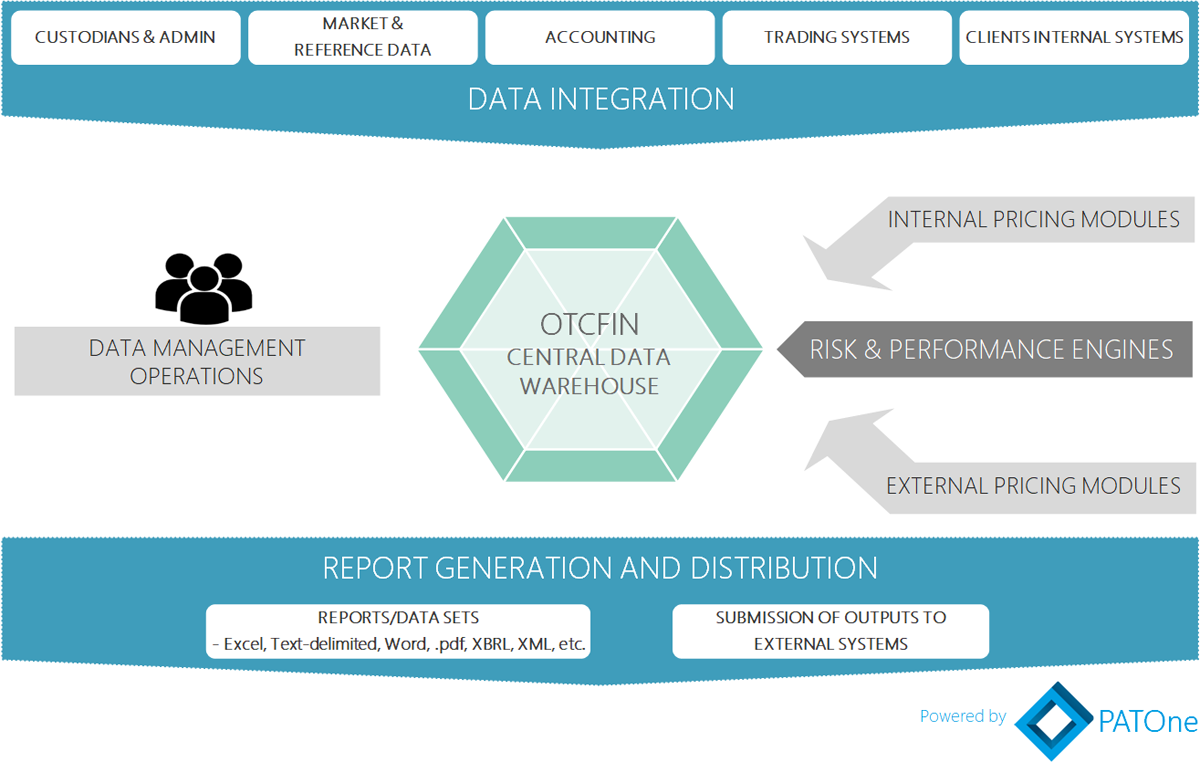

DATA INTEGRATION

PATOne collects, calculates and reports on Solvency II data via its core modules

- Comprehensive Data Model to centralize the required assets and liabilities data

- Powerful Data Management Workflow Engine, Input Tools and Data Monitoring Dashboards to integrate and monitor data and analytics from various upstream and downstream data sources and third-party systems

- Reporting Portal for flexible tailored reporting and interactive analysis

02

SCR CALCULATION

Automated SCR calculation supporting all asset types with up-to-date scenarios specified by the regulation.

03

REPORTING

Supporting EIOPA’s standard QRT templates, Tripartite template in different formats: FundXML, csv, xslx, pdf.