PRIIPs

01

COMPREHENSIVE MANAGED SERVICE

Our experienced team provides stellar customer service to support you in applying the regulation for your specific products. We support calculations for all product types within the scope of the regulation:

- SRI and Performance Scenario calculations

- Transaction costs

- Performance fees

- Insurance cost

02

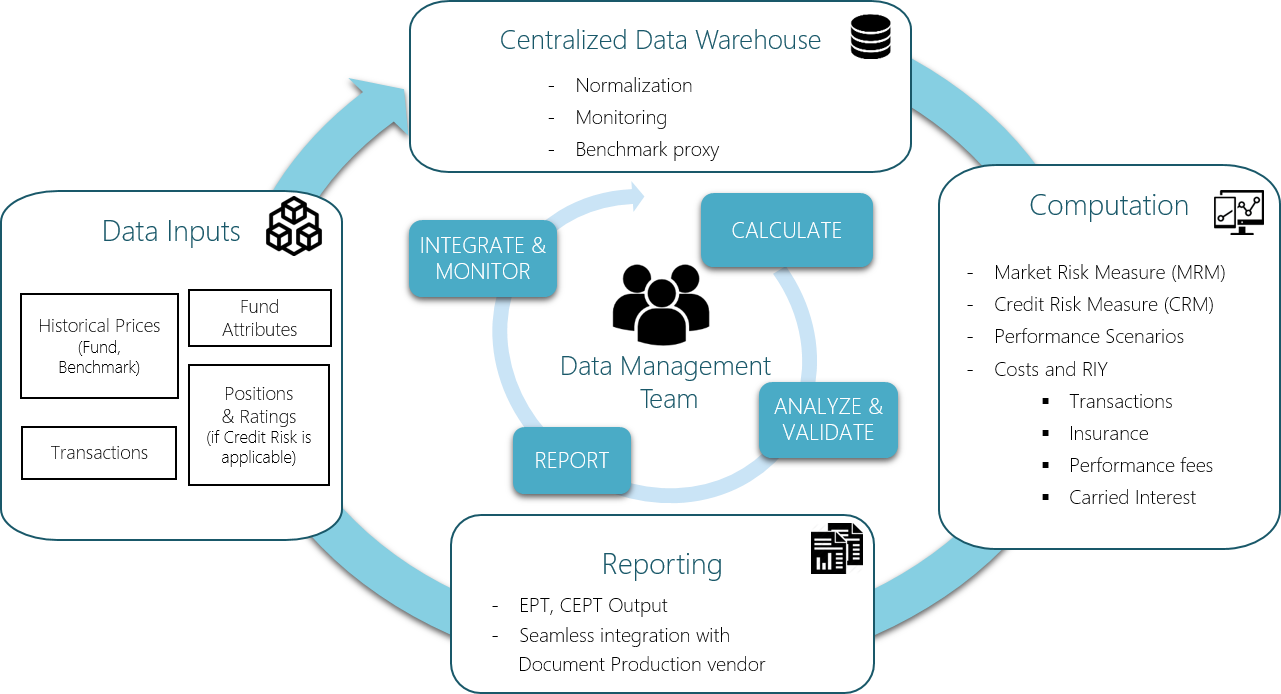

AUTOMATED DATA MANAGEMENT PROCESS

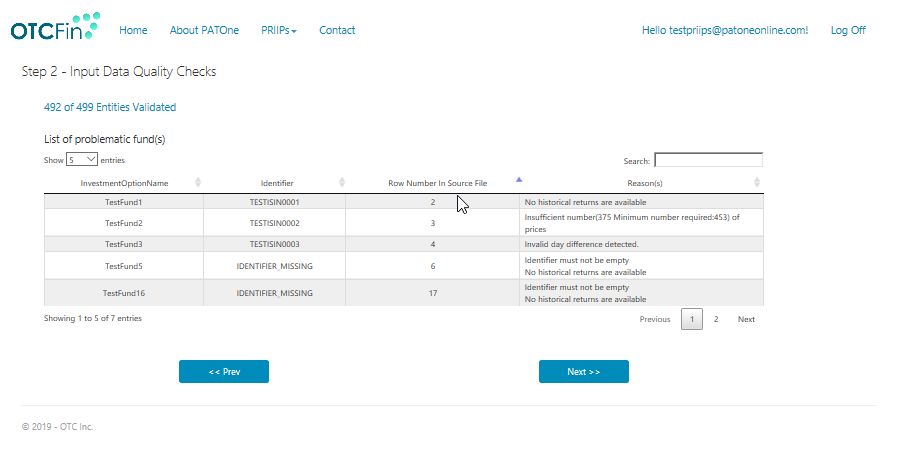

Input data sourcing and validation are performed efficiently by our proprietary PATOne EDM which flexibly handles data provided in different formats. Clients may give us their data in the format most convenient to them.

03

STANDARD REPORT GENERATION

Outputs generated in EPT/CEPT formats. Calculated outputs provided via integration with document producer for KID production

04

ON-GOING MONITORING AND MAINTENANCE

Our team will run the data and computation processes on a regular basis to monitor and ensure compliance of the regulation over time. We also keep abreast with the latest developments in the regulation to ensure that the calculation methodology used remains up-to-date.