PATOne Real Estate

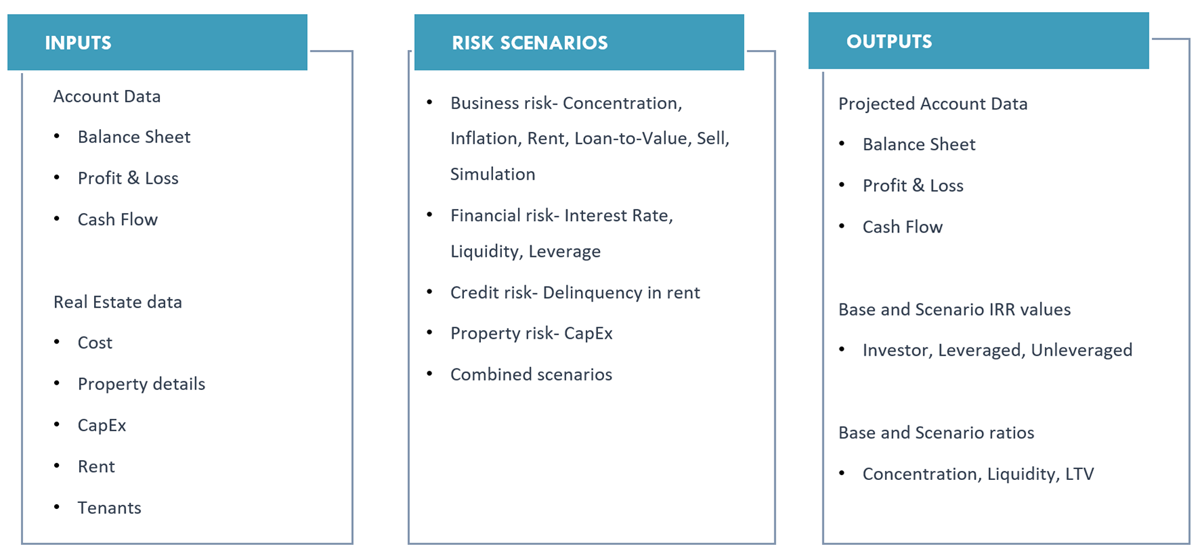

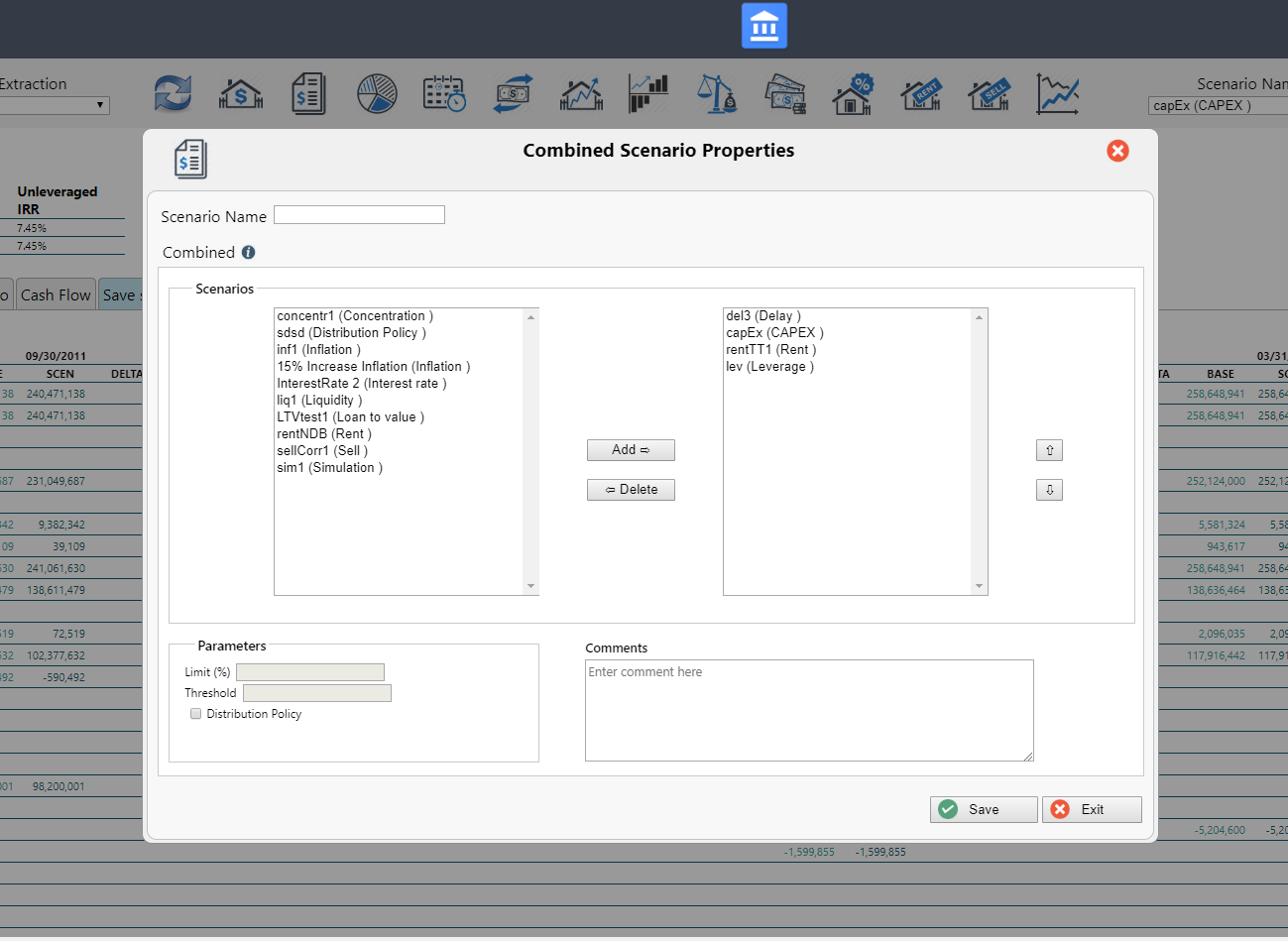

Projects the concentration ratio of the portfolio by type or main use of the buildings. The ratio can be calculated by Acquisition or Market Value.

The inflation scenario allows the user to introduce an extra inflation rate and also configure the distribution policy and minimum liquidity to maintain.

Projects the impact of variations in rent received from one or multiple tenant.

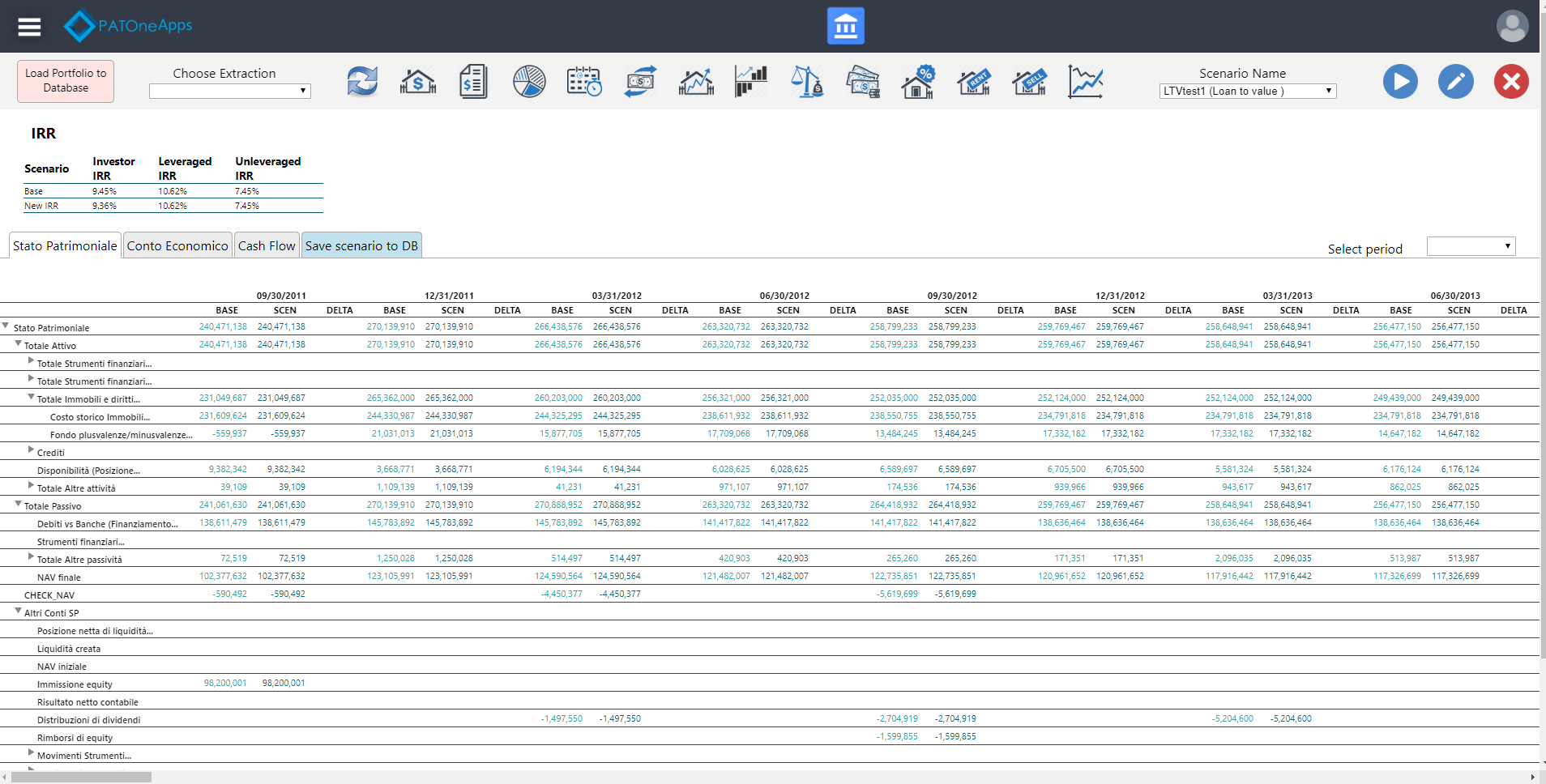

Ratio between liabilities and long—term assets in Balance Sheet for each date.

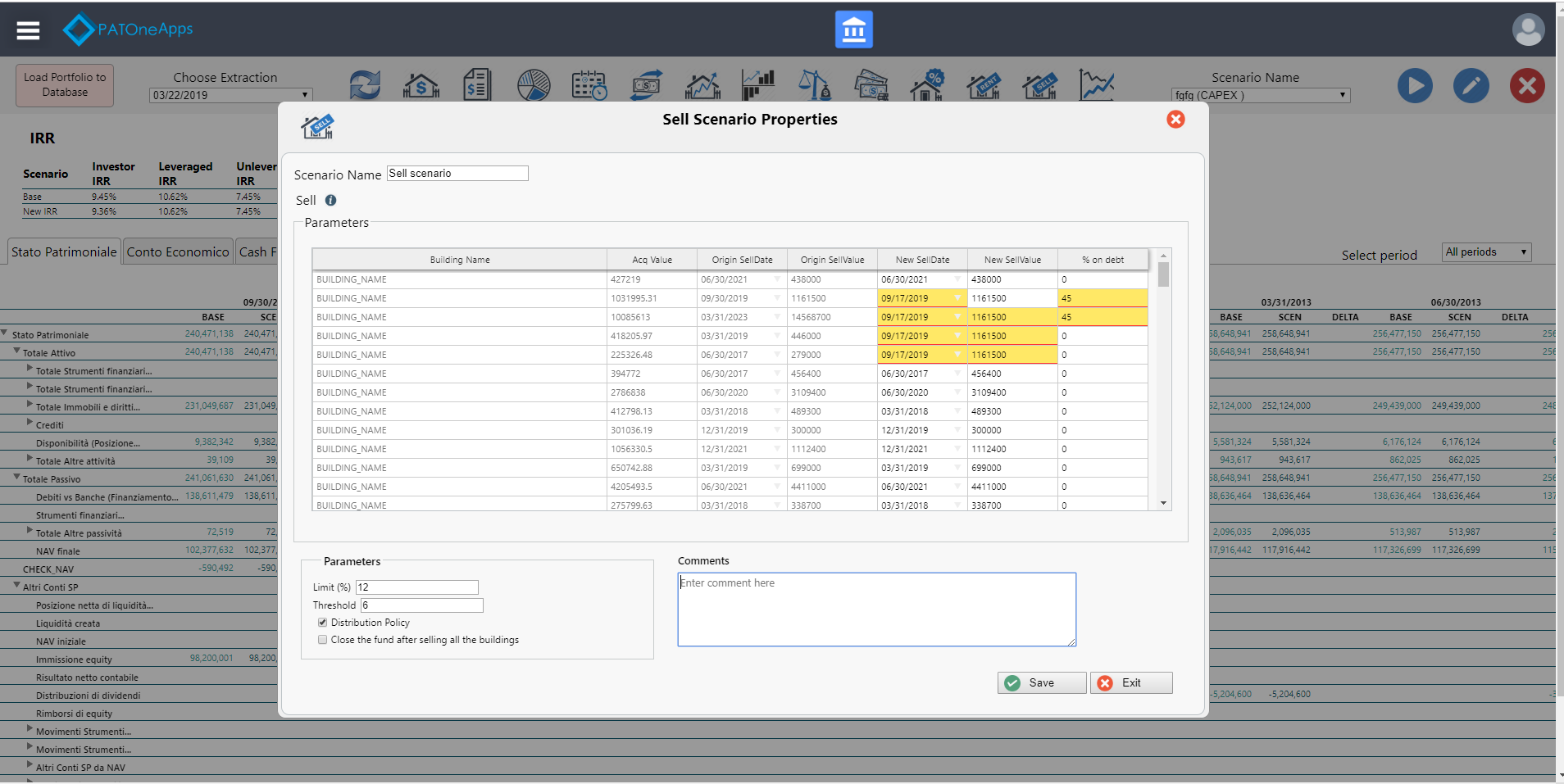

Projects the effect of changes in sell date an/or value.

Executes the yield calculation simulating scenarios where the market value decreases in each iteration by the percentage defined by the user. The simulations will stop when the yield limit or the maximum number of simulations is reached.

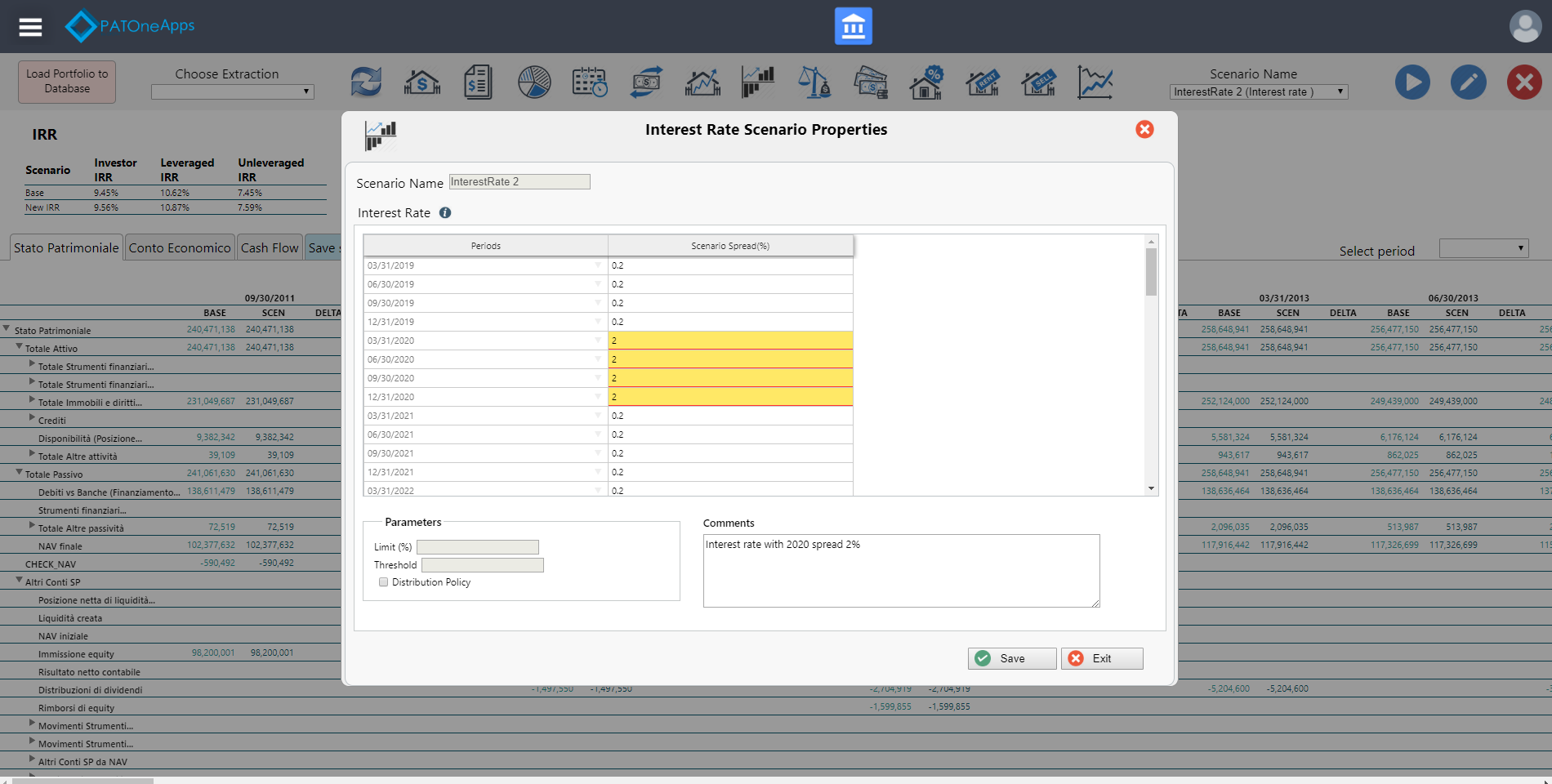

Projects the effect of interest rate changes on the cash flows.

Calculates the percentage of cash available in the fund based on limits and threshold indicated by user.

Projects the effect of changes in capital expenditure.

Project the effect of delinquency in receiving rents. The user may define the initial date of delinquencies and period of delay.